All Categories

Featured

Table of Contents

Indexed Universal Life (IUL) insurance coverage is a sort of irreversible life insurance policy policy that combines the features of standard global life insurance policy with the potential for money value development connected to the performance of a securities market index, such as the S&P 500 (IUL policyholders). Like other forms of irreversible life insurance policy, IUL supplies a survivor benefit that pays out to the beneficiaries when the insured passes away

Cash value buildup: A portion of the costs settlements enters into a money worth account, which earns interest with time. This cash money worth can be accessed or borrowed against throughout the insurance holder's lifetime. Indexing alternative: IUL policies supply the opportunity for cash money value growth based upon the performance of a stock exchange index.

What does a basic Iul Plans plan include?

Similar to all life insurance items, there is likewise a collection of threats that policyholders must be aware of prior to considering this kind of plan: Market threat: One of the key risks connected with IUL is market risk. Since the cash money value growth is linked to the performance of a securities market index, if the index does badly, the cash worth may not expand as anticipated.

Sufficient liquidity: Insurance holders should have a steady financial circumstance and be comfy with the superior settlement needs of the IUL plan. IUL enables flexible premium repayments within specific limitations, but it's vital to keep the plan to guarantee it accomplishes its designated purposes. Rate of interest in life insurance policy protection: People that need life insurance coverage and an interest in cash worth development might discover IUL enticing.

Candidates for IUL need to have the ability to comprehend the mechanics of the policy. IUL might not be the best choice for individuals with a high resistance for market threat, those who prioritize low-priced financial investments, or those with more instant economic requirements. Consulting with a certified financial advisor that can provide personalized support is important before thinking about an IUL plan.

All registrants will receive a calendar invitation and web link to join the webinar by means of Zoom. Can not make it live? Register anyhow and we'll send you a recording of the presentation the next day.

How long does Iul Plans coverage last?

You can underpay or avoid costs, plus you might be able to readjust your death benefit.

Money worth, along with possible development of that value via an equity index account. An alternative to allocate component of the cash money value to a set passion choice.

Insurance policy holders can determine the percentage designated to the fixed and indexed accounts. The worth of the selected index is tape-recorded at the start of the month and contrasted with the value at the end of the month. If the index raises during the month, interest is added to the cash worth.

The 6% is multiplied by the cash value. The resulting passion is contributed to the money value. Some policies compute the index gets as the amount of the adjustments through, while various other plans take approximately the daily gains for a month. No rate of interest is attributed to the money account if the index decreases rather of up.

High Cash Value Iul

The rate is set by the insurer and can be anywhere from 25% to more than 100%. (The insurance company can likewise transform the get involved rate over the life time of the policy.) For example, if the gain is 6%, the engagement price is 50%, and the current money value total amount is $10,000, $300 is added to the cash value (6% x 50% x $10,000 = $300).

There are a variety of pros and disadvantages to take into consideration before purchasing an IUL policy.: Similar to basic universal life insurance policy, the insurance policy holder can boost their premiums or reduced them in times of hardship.: Amounts attributed to the cash worth grow tax-deferred. The cash value can pay the insurance policy costs, enabling the policyholder to reduce or quit making out-of-pocket premium payments.

Indexed Universal Life Financial Security

Numerous IUL plans have a later maturity day than other sorts of universal life plans, with some finishing when the insured reaches age 121 or even more. If the insured is still to life at that time, plans pay out the survivor benefit (but not typically the cash money worth) and the profits might be taxed.

: Smaller policy face values do not use much advantage over routine UL insurance policy policies.: If the index decreases, no passion is credited to the cash money worth. (Some policies provide a reduced ensured rate over a longer period.) Other financial investment cars make use of market indexes as a standard for performance.

With IUL, the goal is to make money from upward motions in the index.: Because the insurer only buys options in an index, you're not straight purchased stocks, so you do not profit when firms pay rewards to shareholders.: Insurers charge costs for managing your money, which can drain pipes cash money value.

What is the difference between Indexed Universal Life Growth Strategy and other options?

For many people, no, IUL isn't much better than a 401(k) - Tax-advantaged IUL in regards to conserving for retired life. Many IULs are best for high-net-worth people looking for means to decrease their taxed revenue or those who have maxed out their other retired life alternatives. For everyone else, a 401(k) is a much better financial investment lorry since it doesn't carry the high charges and costs of an IUL, plus there is no cap on the amount you may make (unlike with an IUL plan)

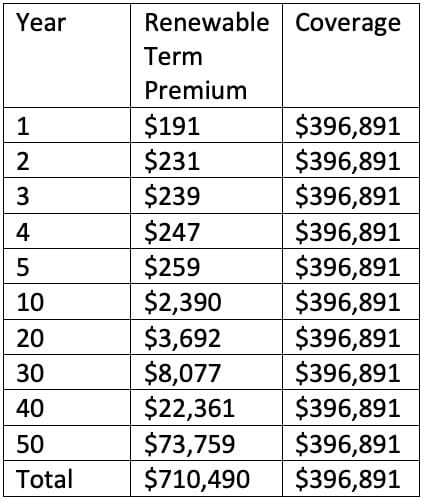

While you might not lose any kind of money in the account if the index decreases, you won't make passion. If the marketplace transforms favorable, the incomes on your IUL will certainly not be as high as a common financial investment account. The high cost of costs and costs makes IULs pricey and considerably less cost effective than term life.

Indexed global life (IUL) insurance offers cash worth plus a survivor benefit. The cash in the cash value account can earn rate of interest with tracking an equity index, and with some commonly designated to a fixed-rate account. However, Indexed universal life policies cap just how much money you can collect (often at less than 100%) and they are based upon a perhaps unstable equity index.

What does Iul Insurance cover?

A 401(k) is a much better choice for that purpose since it does not carry the high costs and premiums of an IUL plan, plus there is no cap on the quantity you may gain when spent. A lot of IUL policies are best for high-net-worth individuals looking for to reduce their taxed revenue. Investopedia does not provide tax, investment, or economic solutions and suggestions.

If you're thinking about getting an indexed global life policy, very first consult with an economic consultant that can discuss the nuances and provide you an accurate image of the real potential of an IUL plan. See to it you recognize how the insurer will compute your passion price, revenues cap, and costs that could be evaluated.

Latest Posts

Fixed Universal Life Insurance

Best Guaranteed Universal Life Insurance

Universal Aseguranza